$

WonkTax

2025 Tax Year Calculator

Estimate your federal, state and local income taxes for the 2025 tax year

Estimate your federal, state and local income taxes for the 2025 tax year

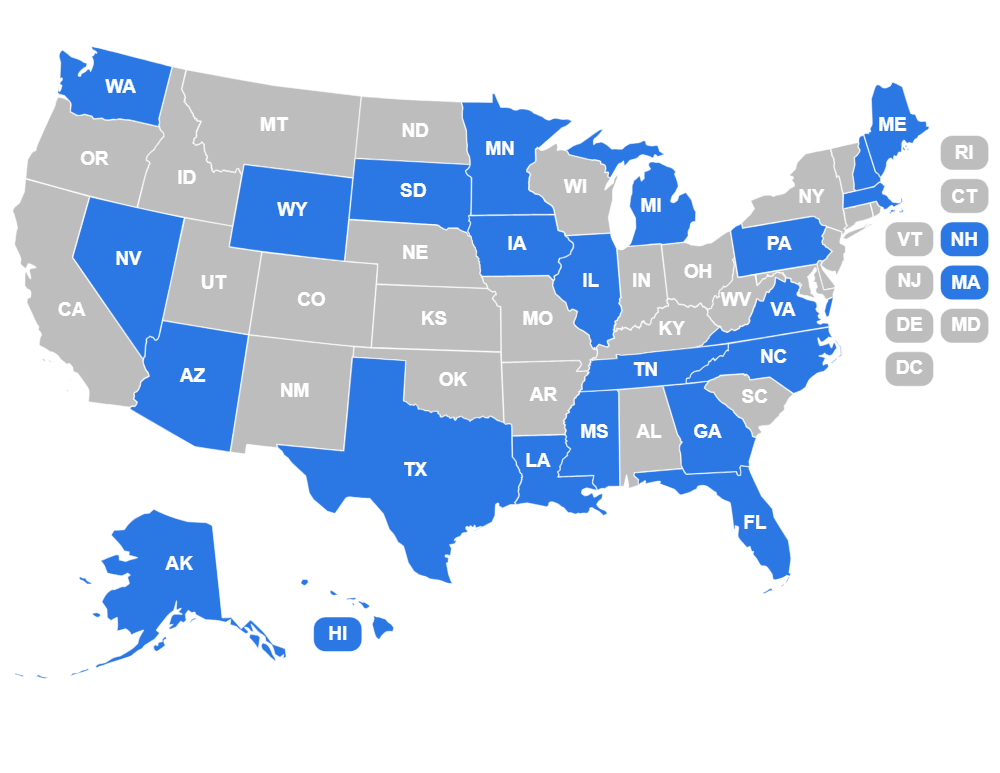

Coverage will increase as state legislatures release tax changes

| Bracket | Rate | Income in Bracket | Tax |

|---|

| Type | Rate | Applicable Income | Tax |

|---|

| Bracket | Rate | Income in Bracket | Tax |

|---|